WEALTH MANAGEMENT

Whether you choose a discretionary or advisory mandate, our approach to portfolio management begins with a thorough understanding of client goals, risk profile and time horizon as well as any other constraints that we carefully consider before proposing investment solutions. Only after we have analyzed the full spectrum of client goals do we propose portfolio allocation, both on strategic and tactical terms. We combine long term value investing bases on core positions with a tactical opportunistic approach to take advantage of markets’ momentum.

The interest of our clients is our main priority. We are independent. Our unbiased and disciplined professional approach to the investment process is based on a neutral relationship with the full spectrum of the best financial institutions and on an unrestricted access to top-class research and products.

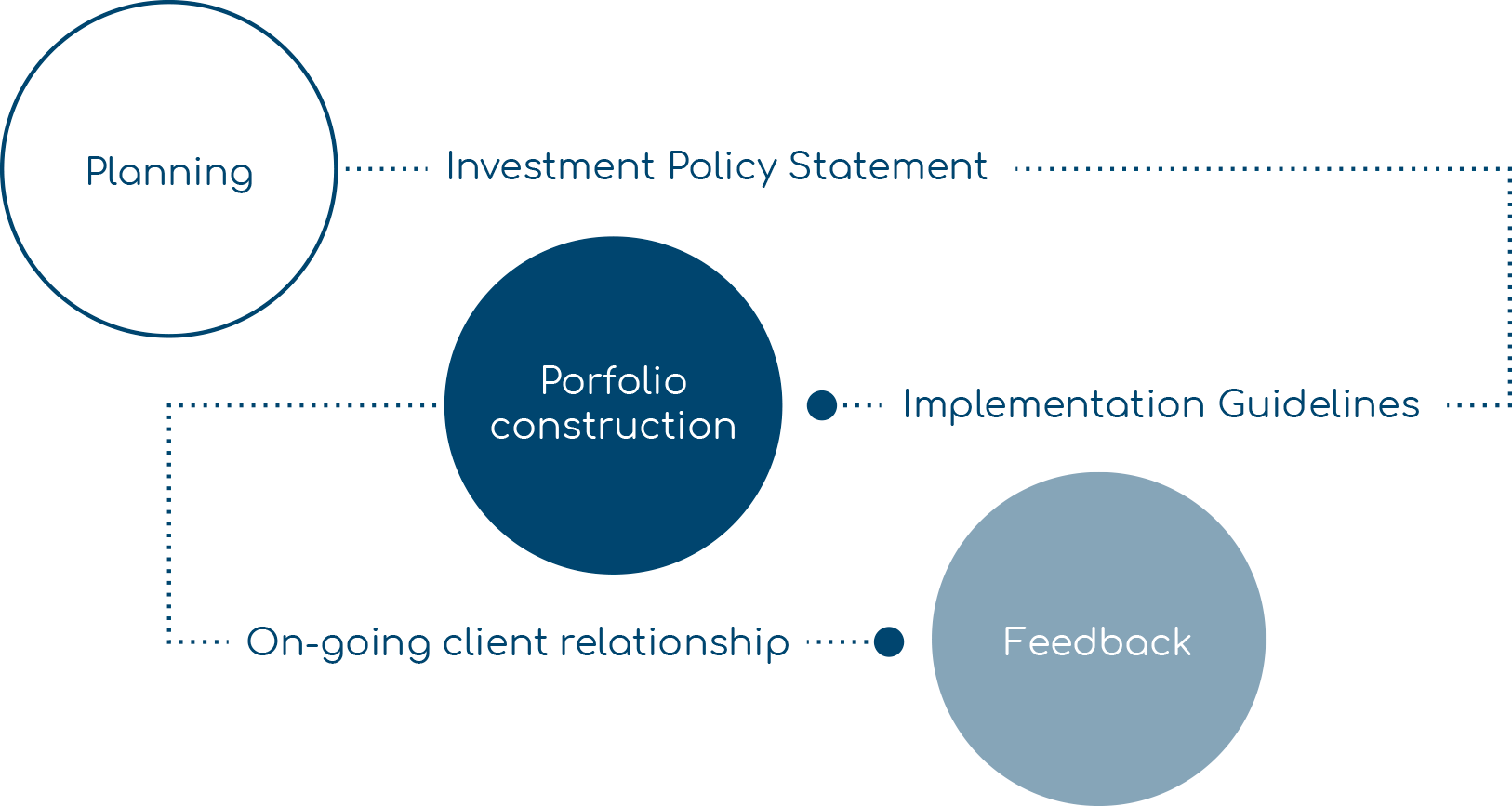

THE PROCESS

PORFOLIO CONSTRUCTION

Asset Allocation

Top-down approach to asset allocation.

Compare risk and return of all asset classes across the Globe, with a bias to Europe and the US.

Assessment of macro data, public policy, geopolitical developments and sentiment indicators, but only insofar they affect market fundamentals.

Idea Generation

Dynamic screening allows us to reduce the investment universe to the assets

that match our investment philosophy.

In-depth analysis of the screening results, using public company data,

corporate interviews, broker research and our own valuation models.

Investment ideas are discussed on the weekly investment committee and analysed

from all angles, with a special focus on those views that challenge our thesis.

Risk Management

Scenario and VaR analysis allow us to simulate the P&L impact of

different shocks.

Diversification is important to us. We limit our total exposure to any

company, geography or theme.

We may invest in low correlation assets to help us improve our

risk-adjusted returns.